SAP Announces Q3 Financial Results

by Robert Holland, VP Research, SAPinsider

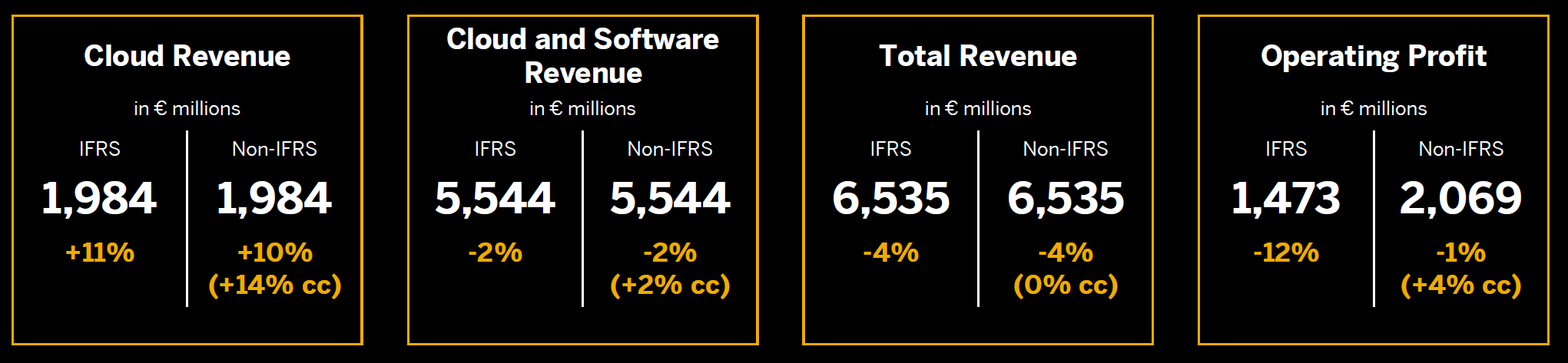

Despite initial expectations of a decrease in revenue in Q2 of 2020 followed by a gradual improvement in Q3, SAP today announced that their overall revenue for the quarter decreased 4% and that their IFRS operating profit decreased 12%. However, while the numbers this quarter were lower, overall revenue year to date was still up 1% year over year.

Software Revenue, Total Revenue, & Profit Fall

While SAP sought to emphasize its continued and accelerated transition to the cloud and has increased its target for cloud revenue to €22 billion by 2025, there was a negative market reaction to the numbers from the German software maker.

Total Revenue decreased 4% year over year in both IFRS and non-IFRS reporting to €6,535 million, Cloud and Software Revenue decreased 2% year over year in IFRS and non-IFRS to €5,5444 million, but the biggest drop was a 12% IFRS reduction in operating profit to €1,473 million (1% in non-IFRS). At the same time Cloud Revenue increased by 11% IFRS (10% non-IFRS) to €1,984 million, though this obviously did not offset the reduction in overall software revenue.

All of these metrics increased for the first nine months of 2020 as a whole, with IFRS Cloud Revenue increasing by 18% year to date, but the numbers for the quarter show that the global economy has not yet begun the recovery that SAP had expected.

A Deeper Examination

Looking at the specific numbers, SAP only reported details for four segments within the organization: Applications, Technology & Support; Concur; Qualtrics; and Services. The only one of those four segments that showed an increased in revenue in Q3 was Qualtrics, which improved by 22% to €169 million year over year. While important, this was offset by the 16% reduction in Services revenue, 14% reduction in Concur revenue, and 2% reduction in Applications, Technology & Support revenue (the largest area by far representing 78% of total revenue). This reduction in services revenue aligns with both research and conversations SAPinsider has had with many customers transitioning to SAP S/4HANA who are spending much of 2020 planning for the future unless they already had projects underway, and is consistent with a reduction in services revenue globally especially as seen with organizations like Accenture and Deloitte.

In the cloud, where SAP reported significant growth, the quarterly statement indicated that there was a 7% reduction in cloud revenue in the Intelligent Spend group (SAP Ariba, SAP Concur, and SAP Fieldglass), with the reduction in Concur revenues having the largest impact on that number. Given that Concur facilitates travel and expense management, that reduction in revenue can be explained by the lack of business travel this year. On the positive side, SAP saw an increase in 21% in actual currency in other SaaS and PaaS revenue to €1,127 million, and a 19% increase in IaaS cloud revenue to €208 million. This indicates that the biggest cloud growth areas for SAP were in areas like SAP SuccessFactors and SAP HANA Enterprise Cloud.

SAP also stated that over 500 SAP S/4HANA customers were added during the quarter which took the adoption total to over 15,100 customers. This is a 20% increase in those running SAP S/4HANA at the same point in 2019, with approximately 8,100 (53.6%) of these customers reported as being live. Of those new customers added this quarter around 45% were net new. While this is a positive sign for adoption of the product outside the existing enterprise ERP landscape, which SAP has previously stated is approximately 45,000 customers, it may also indicate that adoption of SAP S/4HANA within that landscape is slower than expected even though SAPinsider has seen a steady increase in those reporting that they have completed the transition to SAP S/4HANA.

Regionally, SAP reported “resilient performance” in the EMEA region, the only region that saw growth in both cloud and software revenue this quarter. Stating “solid performance” in the Americas and APJ, both regions saw a decrease in cloud and software revenues with only modest growth in cloud revenues (14% in EMEA and only 3% in the Americas). With the US market being the largest globally for SAP, and with many organizations delaying investment due to ongoing market uncertainty, it is no surprise that growth was lower than expected in this region compared to EMEA where many organizations returned to more normal operations during the quarter.

As a response to these results, SAP has updated its business outlook for the remainder of 2020. SAP expects full year operating profit to be in the €8.1—8.5 billion range, a reduction of approximately €200 million, and total revenue to be between €27.2 and 27.8 billion, a reduction of €600—700 million. Even with the continued growth of cloud revenue in Q3, SAP also expects cloud revenue to end up slightly below earlier predictions at €8.0—8.2 billion, a reduction of €300-500 million from the previous guidance provided in April.

What Does This Mean for SAPinsiders?

SAP’s overall performance continues to be greatly impacted by the global pandemic, as is the case with many organizations around the world. What remains to be seen is whether the extended pandemic continues to have a negative effect into Q4, or whether things will improve. To be prepared for whatever happens, SAPinsiders should:

- Look for SAP to continue to push cloud adoption. Alongside the quarterly results, SAP also released a strategy update titled “Accelerating Our Customers’ Business Transformation in the Cloud”, which demonstrates that SAP sees the cloud as the path it needs to take and where it wants customers to be from both an adoption and investment perspective. No matter what your current infrastructure and product usage, SAP will continue to push cloud adoption.

- Expect further emphasis on the transition to SAP S/4HANA. While SAP has shown continued growth in those purchasing SAP S/4HANA, adoption within the existing customer base has only been some of that growth. Even though SAPinsider research has shown that many customers see the benefits that SAP S/4HANA offers from a functionality perspective, the cost of that transition can be expensive. SAP will continue to emphasize this transition and enterprise ERP customers in particular should expect an emphasis on determining their plans for the product.

- Continue to leverage SAP’s focus on the customer. At the beginning of 2020, SAP emphasized the fact that it is focused on the customer. While that message may have been somewhat lost in everything that has happened in 2020, SAP has continued to make customer focus an emphasis. Use this to your advantage during your day to day interactions with your SAP contacts.

- Educate yourself around the current SAP strategy. SAPinsider is hosting our EMEA virtual event from November 17-19, which includes global summits on SAP S/4HANA and Supply Chain. Attendance is free to registered users, and you will have the opportunity to hear from those inside and outside SAP on current strategy, as well as what you need to make your 2021 plans successful.