One-Third of SAP Customers in the Software and Technology Sector Already Run SAP S/4HANA

Industrial Sector Customers More Focused on Centralizing Financial Reporting on a Global Scale

by Pierce Owen, Vice President of Research & Publishing, SAPinsider

SAPinsider recently published its 2020 “SAP S/4HANA Migration Benchmark Report,” which explains how and why SAP S/4HANA adoption has progressed globally over the course of the past year.

The report analyzes the results of an SAPinsider survey taken by 537 members of our audience in Q1 of 2020. This research derivative examines the differences in the adoption progress and drivers of SAP S/4HANA migration strategies between organizations in the software and technology sector and those in the industrial sector.

SAP S/4HANA Adoption Across Sectors

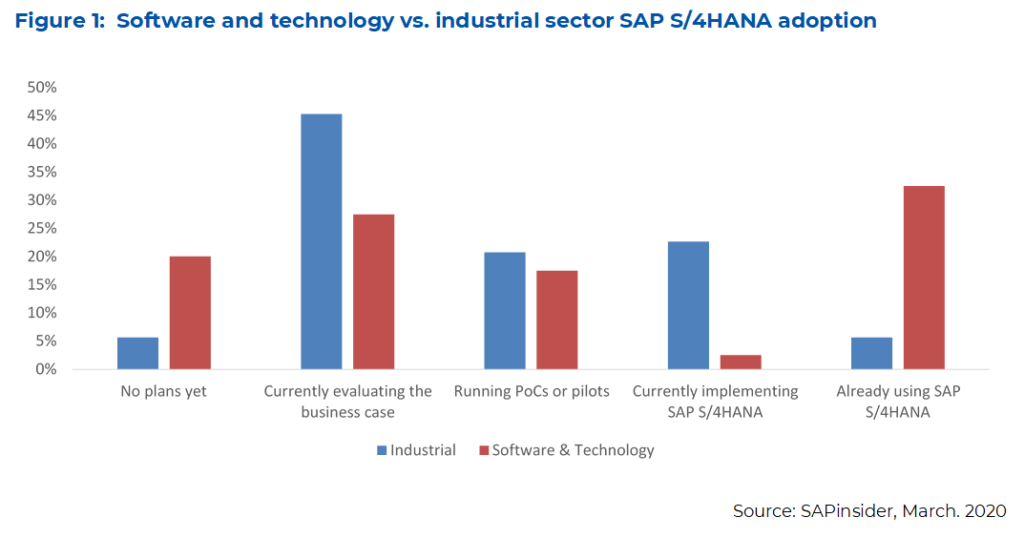

Overall, customers in the software and technology sector have made significantly more progress in their migration to SAP S/4HANA than their peers in the industrial sector. Almost one-third (33%) of survey respondents from the software and technology sector said they already use SAP S/4HANA, versus only 6% of respondents from the industrial sector (see Figure 1).

Interestingly, even though the software and technology sector had a greater adoption of SAP S/4HANA, it also had a much higher share of respondents with no current plans for SAP S/4HANA migration (20% vs. 6%).

This leaves most respondents from the industrial sector evaluating the business case, running pilots, or in the process of implementing SAP S/4HANA. In fact, 23% of industrial sector respondents said their organizations had started implementing SAP S/4HANA versus only 3% of software and technology companies. Even if every company in both sectors that said it has started implementing SAP S/4HANA goes live in 2020, the software and technology sector will still have a greater proportion of companies using SAP S/4HANA.

Migration Strategies for SAP S/4HANA

The most popular strategies to prepare for SAP S/4HANA within each sector reveal a little more of the storyline behind the rapid adoption of SAP S/4HANA by one-third of the software and technology sector and the slightly slower, but eventually larger, migration in the industrial sector.

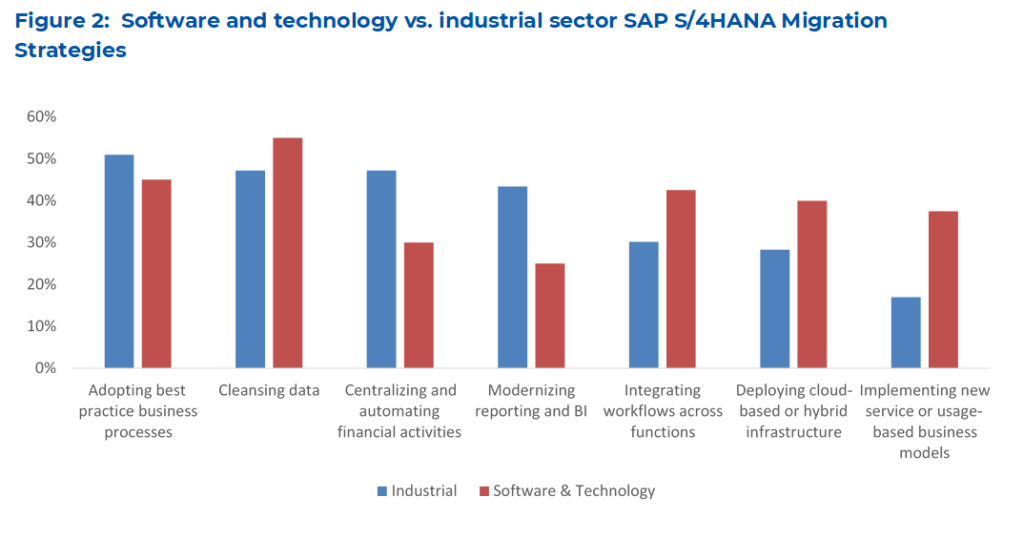

Both sectors chose adopting best practice business processes and cleansing data as key strategies to address the migration, with at least 45% of respondents from each sector choosing each strategy (see Figure 2). The industrial sector differed by putting a much higher emphasis on centralizing and automating financial activities as well as on modernizing reporting and business intelligence (BI).

SAP customers often use Central Finance to connect multiple ERP instances to SAP S/4HANA Finance. This can help with SAP S/4HANA migration as well as use cases such as mergers and acquisitions, consolidation, and organizational change. Modern reporting, BI, and analytics capture data from many parts of the enterprise and empower users to manipulate the data and analyze it from different perspectives. These reporting tools shorten the financial close and empower financial professionals to provide more value to their organization with increased capacity and capabilities.

One manager of SAP systems at a steel company shared, “Back in 2012, we implemented SAP BusinessObjects BI on HANA and built an analytics roadmap starting with the finance function. We’re still not capturing the correct or complete data. Users make certain rules or algorithms but do things their own individual way with no truth to the data. We need centralized financial data and the modern reporting tools in SAP S/4HANA.”

Alternatively, the software and technology sector more commonly chooses integrating workflows across functions, deploying cloud-based or hybrid infrastructure, or implementing new service or usage-based business models.

Integrating workflows across functions ties well with the common strategy to adopt best practice business processes, but whereas the industrial sector focuses more on financial processes, software & technology companies focus on integrating different functions.

Additionally, software and technology companies chose to deploy cloud-based and hybrid infrastructure significantly more than industrial sector companies. The industrial sector has a seemingly well-earned reputation of holding a conservative attitude towards the cloud, while the tech sector has adopted a much more aggressive posture.

An earlier SAPinsider research report on “SAP S/4HANA in the Cloud” found that the need for agility in deploying ERP instances drove cloud infrastructure strategies. Therefore, it should not be a surprise that the sector with a greater proclivity towards cloud infrastructure leads the way in SAP S/4HANA adoption.

One respondent who chose a hybrid cloud strategy said, “We have implemented a hybrid cloud model to maximize performance, compliance, and privacy governance.”

Finally, software and technology organizations chose implementing new service or usage-based business models at a significantly higher rate than industrial sector respondents. While as-a-service (aaS) business models have started to gain traction in the industrial sector, they carry much more complexity for physical products and hardware than for software. Selling a physical product aaS often requires an insurance policy to cover replacement if necessary. Selling software aaS (SaaS) still requires a great deal of adjustment in financial and operational processes, but generally carries less complexity than selling physical products aaS.

Therefore, software and technology companies have made a bigger push for these types of business models and the software, such as SAP S/4HANA, that has functionality to support these business models.

What Does This Mean for SAPinsiders?

Based on our research, the following considerations can help SAP customers from different sectors better plan their SAP S/4HANA migration:

- If considering a service-based business model, align its implementation with SAP S/4HANA migration. SAP S/4HANA has functionality built in to specifically support these types of business models. Software and technology companies have made progress with both. When running pilots and user acceptance testing, experiment with this functionality.

- To speed up SAP S/4HANA deployment, look to the cloud. SAPinsider research has shown that cloud infrastructure not only improves ERP performance but also supports more agile deployment of ERP instances. Software and technology companies have migrated to SAP S/4HANA faster than industrial companies partly due to their openness to cloud-based infrastructure.

- Adopt best practice business processes AND integrate workflows across functions. SAP S/4HANA offers improved functionality for financial processes but it offers tools for other functions as well. Integrating workflows across functions end-to-end can help maximize the impact of new best practices.

- If centralizing financial activities and modernizing reporting, the migration may take longer. The research report benchmarked migration progress to SAP S/4HANA, not business performance. While the industrial sector lags over a year behind the software and technology sector in SAP S/4HANA adoption, that does not mean these companies have started to struggle financially; they simply have competing priorities. Centralizing financial activities and modernizing reporting can help with and take advantage of the SAP S/4HANA migration and can potentially help companies meet their objectives.

Following this strategic guidance should help SAP customers better plan for their SAP S/4HANA migration.

Make sure to download and read our full report, SAP S/4HANA Migration Benchmark Report.